Legacy Circle

An Initiative Investing in Our Future Clients

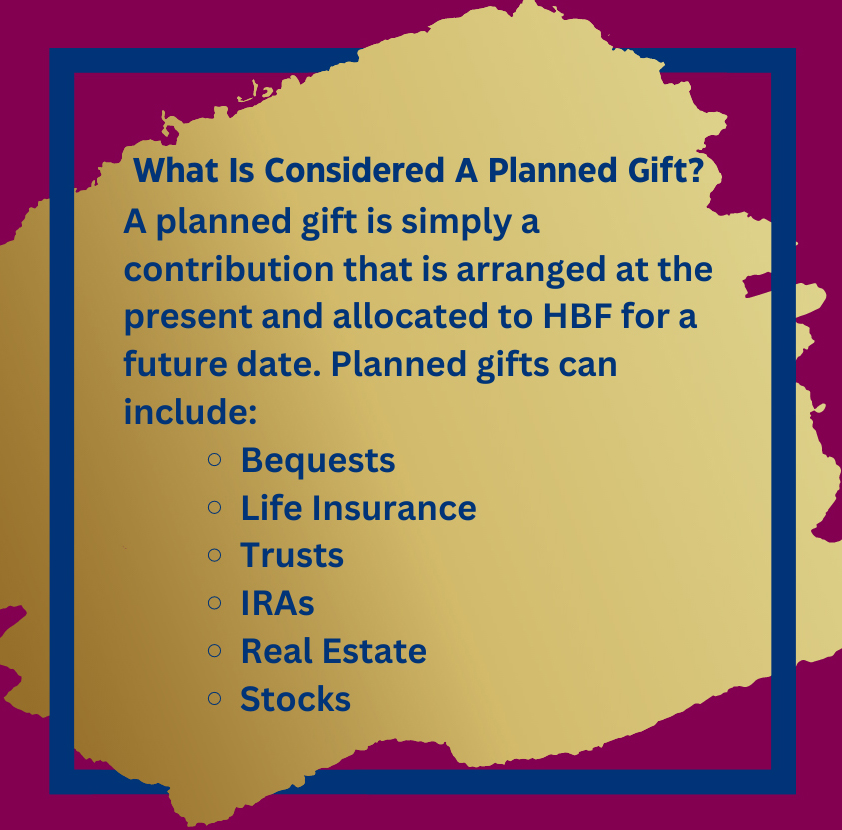

HBF’s Legacy Circle is a planned giving initiative to create your lasting impact on Home Builders Foundation. Legacy Circle members will have an opportunity to advance our mission to build independence, provide opportunities and elevate lives for people in our community today, tomorrow, and forever. We look forward to collaborating with you to create a legacy gift tailored to your resources. Working together to craft your planned giving opportunity allows the HBF team to thank you for creating a lasting impact and recognize you as an HBF Legacy Circle member.

Legacy Circle Members Receive:

- The opportunity to leave a legacy, ensuring the cause you care about will be long remembered

- Reassurance that accessible home modifications will be possible today, tomorrow, and forever for HBF’s clients

- Recognition in HBFs Good News – a quarterly update to HBF’s key supporter

To become a Legacy Circle member

Contact Lauren Knudsen at 303-551-6722 OR LKNUDSEN@HBFDENVER.ORG

Have you already included HBF in your will or trust? If you have already arranged a planned gift for HBF please let us know so we can thank you for your support.

4 Ways to Give

1

Appreciated Stock

By gifting an appreciated stock that you have owned more than one year, you can avoid long-term capital gains (up to 23.8% depending on your tax bracket) while receiving a deduction for the entire value of the stock gifted.

2

IRA Charitable Contributions

If you are subject to Required Minimum Distributions from you IRA, but don’t need the money, gifting directly to charity (up to $100,000 per year) can minimize your tax bill and maximize how much you give to charity.

3

Donor Advised Funds

Take the tax deduction now, give to the charity of your choice later. This is a great strategy for “big” income years – maybe you sold a business, or had a giant bonus and would like to mitigate some of the tax liability.

4

Legacy Planning

Extend your legacy beyond your lifetime through your estate plan. Continue supporting HBF now and forever through your will, adding a charitable rider to your life insure policy, or other estate planning options.

Consult your estate planner and tax advisor to determine the best way for you to become an HBF Legacy Circle member.